Anand Madhusudanan, CPA; Luis Cunha; Wilfredo Fernandez, CPA; and Ellen Kera, CPA

The Tax Cuts and Jobs Act (the “Act”), was signed into law on December 22, 2017 and encompasses many changes to individual, corporate, pass-through entities, and trust taxes. The Act will have wide-sweeping implications for the nation’s entire economy and many of these changes will directly impact automobile dealerships and its owners. The following is a summary these changes.

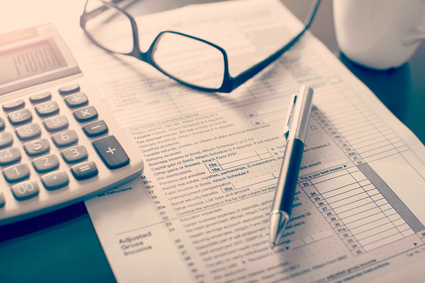

New deduction for pass-through income

- Generally, for tax years beginning after December 31, 2017 and before January 1, 2026, a non-corporate taxpayer (including a trust or estate) who has Qualified Business Income (QBI) from a partnership, S corporation, or sole proprietorship is allowed a 20 percent deduction from QBI based on various limitations. This deduction could be a substantial savings to owners of dealerships. If applicable, the deduction related to the pass-through income can reduce the effective tax rate paid for dealership taxable income, from 37 percent to 29.6 percent.

Reduction of Corporate Tax rates

- Under the Act, C corporations are taxed at a flat rate of 21 percent (the previous tax law had a graduated scale that topped out at 35 percent).

- Some have said that the lowering of the corporate tax rate to a lower rate than the individual tax rate is a signal to convert partnerships and S corporations to C corporations. While there may be circumstances where this is advisable, in general, the lower tax rate (21 percent) is offset by the fact that, when the remaining earnings of the C corporation are distributed and taxed as a dividend, the double taxation will create an almost 40 percent federal tax rate – a rate higher than the maximum individual rate of 37 percent and certainly higher than the 29.6 percent effective rate on qualified flow-through business.

Section 179 expenses

- For property placed in service in tax years beginning after December 31, 2017, the maximum amount a taxpayer may expense under code section 179 is increased to $1 million, and the phase-out threshold amount is increased to $2.5 million.

Temporary 100 percent bonus depreciation on qualified business assets

- A 100 percent first-year deduction for the adjusted basis is allowed for qualified property acquired and placed in service after September 27, 2017, and before January 1, 2023. Thus, the phase-down of the 50 percent allowance for property placed in service after December 31, 2017 is repealed. The additional first-year depreciation deduction is allowed for new and used property. (In later years, the first-year bonus depreciation deduction phases down, beginning with assets placed in service after December 31, 2022.) Beginning in January 2018, dealerships will not be able to utilize the 100% bonus depreciation, since they are allowed to fully deduct the interest on floor plan financing.

- It is extremely important for dealerships to review fixed assets placed into service after September 27, 2017 and prior to December 31, 2017, to determine if they can take advantage of the 100 percent bonus depreciation, prior to the filing of their 2017 income tax return. Dealerships that completed a factory-required facility image renovation should pay particular attention to the new depreciation provisions.

Limitation on deduction of business interest

- For tax years beginning after December 31, 2017, every business, regardless of its form, is generally subject to a disallowance of a deduction for net interest expense, in excess of 30 percent of the business’s adjusted taxable income, with few exceptions.

EXCEPTIONS:

- Average annual gross receipts for a three-year tax period ending with the prior tax year that do not exceed $25 million.

- Floor plan financing (financing for the acquisition of motor vehicles). Dealerships will be able to deduct a floor plan interest expense. However, any other interest incurred (i.e. working capital loans, equipment financing) may be limited under the new law. (See above regarding bonus depreciation.)

Entertainment expenses

- Under current law, a taxpayer could deduct up to 50 percent of expenses relating to meals and entertainment. For amounts incurred or paid after December 31, 2017, deductions for entertainment expenses are disallowed, eliminating the subjective determination of whether such expenses are sufficiently business related. The 50 percent deduction allowed for business meals is still applicable.

Estate & Gift Tax Exemption

- For estates of decedents gifted after December 31, 2017 and before January 1, 2026, the Act increases the estate and gift tax exemption from $5.6 million to $11.2 million ($22.4 million for a married couple). This increase provides an opportunity for dealership owners to review succession plans and the transferring of ownership interest to the next generation.

The provisions of the Act provide many opportunities and some pitfalls. More than ever, owners of automobile dealerships need to consult their tax advisers to understand both the business and personal implications of the new tax laws.

Citrin Cooperman Automotive Dealership Services: Over the past 30 years, Citrin Cooperman has become a recognized leader in the auto industry through excellence in client service and by sharing our extensive industry knowledge. Our Automotive Dealership Services practice is comprised of a team of professionals who specialize in helping dealers grow their businesses and remain profitable. The practice is led by two of theindustry’s most knowledgeable and reputable professionals, Wilfredo Fernandez and Ellen Kera. In the fall of 2017, Citrin Cooperman and Ellen Kera and Company joined to form one of the largest automotive dealerships CPA firms in the region, offering a full spectrum of professional advisory services, industry knowledge, and thought leadership, to automotive dealers across the nation. Using our depth of specialized resources, we aim to engender a viable and sustainable environment for automotive dealerships through improved access to industry intelligence that directly affects their operations. For additional information please contact Wilfredo Fernandez at wfernandez@citinrcooperman.com or Ellen Kera at ekera@citrincooperman.com

Citrin Cooperman Automotive Dealership Services: Over the past 30 years, Citrin Cooperman has become a recognized leader in the auto industry through excellence in client service and by sharing our extensive industry knowledge. Our Automotive Dealership Services practice is comprised of a team of professionals who specialize in helping dealers grow their businesses and remain profitable. The practice is led by two of theindustry’s most knowledgeable and reputable professionals, Wilfredo Fernandez and Ellen Kera. In the fall of 2017, Citrin Cooperman and Ellen Kera and Company joined to form one of the largest automotive dealerships CPA firms in the region, offering a full spectrum of professional advisory services, industry knowledge, and thought leadership, to automotive dealers across the nation. Using our depth of specialized resources, we aim to engender a viable and sustainable environment for automotive dealerships through improved access to industry intelligence that directly affects their operations. For additional information please contact Wilfredo Fernandez at wfernandez@citinrcooperman.com or Ellen Kera at ekera@citrincooperman.com