By Dave Cantin, CEO and Founder, The Dave Cantin Group

Unless you’re a poet or a heavy metal musician, chances are good that you don’t sit around thinking about your mortality all day. You’re too busy running your dealership business and living your life. The problem, however, is that your business and your legacy could be thrown into chaos if you found yourself exiting your business without a concrete plan. And nobody enjoys chaos (except, perhaps, for poets or heavy metal musicians).

The data is surprising when it comes to succession planning (or lack of it). A recent survey performed by the National Alliance of Auto Dealer Advisors (NAADA) found that nearly one-third of auto dealers do not have a succession plan in place, though fully half of them recognize the importance of succession planning. For those that do have a plan in place, 79 percent are seeking internal transition to a business partner or family member.

Those without plans are taking huge risks. Most principals at auto dealerships oversee day-to-day operations, so if something were to happen to them, it would remove one of the key parts (perhaps the key part) of the business. To protect your legacy and ensure your business continues to thrive even in the event of a catastrophic occurrence, it’s critical to engage in timely and thorough succession planning now.

What Is Timely, Thorough Succession Planning?

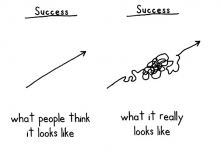

It’s about taking all the moving parts of the business and assessing them to help dealers determine where they are today, where they want the business to go in the future and how to get there. Assessing what needs to be done will allow you to execute your success plan with the least amount of friction.

First, you need to determine the focus of your plan, so you can best protect your business:

- Are you emphasizing growth, and do you plan to add stores?

- Are you planning for growth before exit?

- Or are you focused on exiting, so you need to plan a strategy to maximize the value of your business?

Making this determination is a critical component of protecting your legacy and ensuring success. From here, you can build a starting position and a framework to strengthen your succession plan to ensure a relatively easy passing of the baton. There are some major pitfalls to avoid before you get there, however. Many of them involve paperwork.

Decoding the paperwork. To make an effective transition plan and avoid running into problems and delays in the future, you need to take a close look at your dealer agreements and franchise policies, and Dave Cantin Group can help you with this. We’ll take a thorough look at all your agreements and policies. Next, we’ll make a thorough and timely analysis of these factors to build a framework for next steps.

Whether your plan is for an internal transition or sale to a third party, we’ll read the documents and help you understand all the fine print related to manufacturer rights, something that trips us many dealers. The delicate details of a franchise agreement and the necessary factors to approve potential buyers are just a few of the things we can help dealers familiarize themselves with. To ensure succession planning without a hitch, these steps need to be taken carefully and thoroughly.

Defining the roles. Specifics here mean everything. We’ll help you determine and spell out what’s expected of you as the dealer, and what’s expected of the successor. In the event of death or retirement, navigating the exact path and putting it all on paper might be nerve-wracking now, but it can save stress, time, headaches and money later. (It can also help prevent family rifts.) Who will handle the decision-making? How will disputes be resolved? These questions and more should be answered in advance and in detail.

Getting an early start. Early planning costs far less than leaving it to chance and coping with the avalanche of legal and financial troubles that can arise from poor or incomplete planning. Investing in your success plan upfront now will save you hundreds of thousands — maybe millions – of dollars later. When’s a good time to start? We recommend that succession planning for any dealer should begin between the ages of 45 to 55.

Early succession planning will help you:

- Explore the different areas of your business that are critical to address when looking towards succession planning;

- Analyze key aspects of your business to determine next steps towards succession planning;

- Identify key people in your organization who will support the succession planning process; and

- Develop an action plan to take tangible steps towards succession planning development.

When you’re not succession planning, you’re not protecting your legacy. Succession planning is a critical component of protecting a dealership’s legacy – your own legacy — and ensuring business success for the future.

Dave Cantin Group is a full service automotive M&A firm focused on building long term relationships. Contact DCG today for a complimentary succession planning consultation HERE.