By Brian Alwine

It would be easy to look at the drop in the six publicly traded dealership groups’ stock prices in the first three weeks of March 2020 and develop a view that the sky is falling. An average decline of nearly 50% in such a short period is a frightening amount of volatility.

These are clearly challenging and unprecedented times, with large swaths of the economy temporarily shutting down in response to COVID-19. However, following are three reasons to be encouraged by a long-term view.

- 20-Year Market Perspective

- Enterprise Value is Less Volatile than Market Cap

- Competitive but Collaborative Industry

20-Year Market Perspective

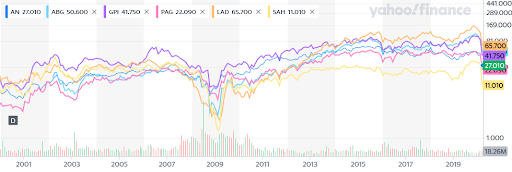

There are six well established, publicly traded automobile dealership groups, Asbury Automotive Group, Inc. (ABG), AutoNation, Inc. (AN), Group 1 Automotive, Inc. (GPI), Lithia Motors, Inc. (LAD), Penske Automotive Group, Inc. (PAG), and Sonic Automotive, Inc. (SAH). The following chart, reflecting activity through March 23, 2020, shows that they have weathered prior severe storms in 2000-2001 and 2008-2009.

We all know that past performance is no guarantee of future results. Yet, dealers can take some comfort from the fact that these companies have survived and ultimately thrived through other significant challenges during the past 20+ years.

Here is a current example of the long-term view one investor is taking. On March 23, 2020, Yahoo! Finance reported that David Abrams, leader of Abrams Capital Management, had disclosed his firm increased its stake in Asbury Automotive Group by 11.34% in the prior week. The report noted that he “follows a fundamental, value-oriented approach to stock picking,” wherein his firm looks for long-term opportunities.

Enterprise Value is Less Volatile than Market Cap

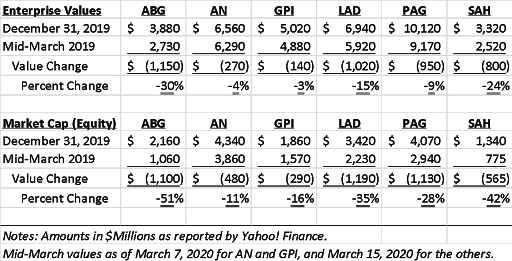

Another important factor is that volatility in the common stock prices of the publicly traded groups does not necessarily reflect on the enterprise value of these groups or of privately held dealerships. The following example shows how this plays out.

Let us say you own a $100,000 piece of equipment, on which you owe $60,000 to a lender, giving you $40,000 of equity. If the value of the equipment drops $15,000 to $85,000, your equity value will have declined 37.5%, from $40,000 to $25,000. However, the value of the equipment itself has dropped only 15%. This is like what has happened with the public dealership groups’ common stock value (Market Cap), as demonstrated in the chart below.

If your dealership is similarly leveraged with debt, it is possible your equity value has taken a similar hit as the public companies’ stock price in recent weeks. However, that does not mean dealerships’ overall enterprise value has fallen 50%.

Competitive but Collaborative Industry

While the dealership industry is highly competitive, with numerous manufacturers and dealers striving to capture consumer spending on automobiles, it is also collaborative. Dealers meet regularly through the National Automobile Dealers Association, State Automobile Dealer Associations, NCM Associates Automotive 20 Groups, among many others. These groups allow dealers to share best practices and resources, strengthening the overall position and long-term viability of the dealership industry.

In these trying times, both large banks and manufacturer finance arms are taking steps to work with dealers. In some cases, this is in the form of lower floorplan rates or temporarily waiving curtailments. In other cases, this is in the form of allowing interest-only payments on existing mortgages or capital loans for periods of 90 days up to six months. Some dealer vendors are waiving or discounting certain service fees through March, April or even longer.

Conclusion

The 20+ year history of the public dealership groups shows this is not a time to panic, as highlighted by a recent “smart money” investment in the industry. This is a time to be proactive in preparing your dealership to handle a period of lower in-person sales and service activities. Dealers can be encouraged that the enterprise value of dealerships is generally not as volatile as publicly traded common stock prices. Finally, the collaborative spirit in the dealership industry reflects how everyone is in this together and can rally in difficult times.

Brian M. Alwine, CPA, ASA has 20 years of experience in business valuation. He has worked with hundreds of automobile dealerships across the USA, including some of the largest privately held dealership groups in the country. Brian is a Director with Redwood Valuation Partners, a national boutique business valuation firm.

Disclaimer: The views expressed herein are those of the author and do not necessarily reflect the official position of any other organization, employer or company. These views are subject to change based on new information and rapidly changing circumstances. Past performance in the markets is no guarantee of future results. This article is for informational purposes only and should not be considered professional investment advice.