By Bruno Lucarelli

In 2004, I was selling Autotrader.com’s used car listing service. Even that far into the internet age, most car dealers still likened the technology to LeCar – it’s cute, but it’s not gonna last.  So a strong majority chose not to have a website. The internet represented change, a frightening prospect for many in the automotive industry. On top of that, the standard month-by-month sales goal system did not give dealers time to sit down and consider long-term strategy changes that would improve their revenue and market share while keeping them relevant.

So a strong majority chose not to have a website. The internet represented change, a frightening prospect for many in the automotive industry. On top of that, the standard month-by-month sales goal system did not give dealers time to sit down and consider long-term strategy changes that would improve their revenue and market share while keeping them relevant.

In 2019, the landscape hasn’t changed much. Most OEM stores are owned by hundreds of separate, medium-sized companies that employ General Managers who live their lives by the clock and the calendar. They abide by the age-old monthly strategy that leaves little time to examine or consider business models that are changing the industry, and very possibly besting them.

Technology Rises

Having had the unique privilege of working major new initiatives at Autotrader.com, eBay Motors and Edmunds.com, I can safely say that hundreds of stores are their own worst enemy in this regard. Local dealers are averse to change, and this allowed the creation and growth of billion-dollar franchises that took advantage of this aversion. Many dealers complain that these companies use the average dealerships’ inventory to build their businesses, but fail to remember that these companies were the first to offer a digital presence to hundreds of dealerships that refused to put together their own websites.

This is where outsider companies such as Carvana, Vroom and others rose to the occasion. They cater to younger, digitally-oriented customers that dealers miss. If there’s not an app for it, they aren’t interested. Try explaining this to a GM that is rushing across the real-life sales floor to save another deal that hits his hundred-vehicle quota for the month.

One can cite failures at the OEM level as well, allowing the Carvanas of the world to “sneak up” on their franchisees while creating shortages of quality auction inventory with their VC funds (even though they are losing thousands per vehicle) and cutting into store profits. There’s plenty of blame to go around, but as we point fingers it’s still the average, medium-sized dealer that is suffering the negative effects of younger buyers fleeing the traditional dealership car-buying experience.

The biggest sticking point with stores seems to be financing. Many are not taking advantage of available tools that allow the prospect to complete all financing online.

“Most tools on the market offer no actual lender approvals and generic products, forcing the customer back into a decision point once they reach the dealership.” according to Devon Ader, Senior Director of Sales at Autofi.

Autofi and similar companies offer dealers website widgets for the customer to receive real-time lender approval, as well as access to F&I products specific to the vehicle of their choice and their financial needs.

Dealers vs. Online

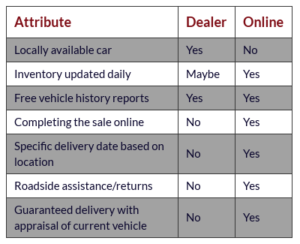

What kind of tools does a store need to play catch up in the growing online sales space? The number of ready-to-buy customers at the bottom of the funnel have several tabs open at once, comparing the dealerships’ online experience with Carvana and comparable stores. So what’s the tipping point that gains or loses the sale? Check out how the average used car dealership stacks up against online car sales powerhouses.

A deeper dive into this chart will reveal why online car sales are more appealing to people than a dealership experience:

A deeper dive into this chart will reveal why online car sales are more appealing to people than a dealership experience:

- Inventory moves best when there are at least a dozen pictures or more of every used vehicle on the lot, along with a good description of a locally available car.

- Prospective customers want to make sure the car is still available, so inventory must be updated daily. Carvana and Vroom are pretty quick to pull sold inventory from their offerings. Vroom even puts a “sale pending” notification if the car is in play.

- Many stores offer free CarFax vehicle history reports as does Carvana.

- The traditional car buying experience focuses on getting the purchaser into the dealership. This is the only way most dealerships know how to be profitable. Completing the sale online is completely foreign to that structure.

- Carvana actually specifies a delivery date of the vehicle based on customer location. I have yet to see a dealer add this simple but effective feature.

- Vroom offers free 24/7 roadside assistance for one year on every single vehicle with some restrictions. Carvana offers a 100 day/4189 mile “Worry Free Guarantee” and a seven-day return program. Franchise dealers offer Certified Pre-Owned (CPO) roadside assistance package on qualified cars only. Shoppers looking at non-CPO used inventory can only opt for gap coverage which is typically overpriced.

- Both Carvana and Vroom guarantee they will not only deliver the vehicle, but offer an estimate on the trade-in. They will come to your home, assess the car and cut a check, all while dropping off the newly-purchased vehicle. This is a real game-changer, and a completely foreign way of doing business to most dealers. It’s the essence of the Carvana and Vroom model. Why are so many dealers struggling with this concept? Many stores have already implemented service pickup and delivery. Why not use the same personnel to accomplish sales pickup and delivery?

Dealers Can Go On The Offensive

Most stores are probably missing only a few elements to stem the rapidly increasing flow of lost customers to the Carvanas and Vrooms of the American marketplace.

- Add a delivery date and time (for example, a promise of a two-day delivery) to every used car listing.

- Add a true online financing app to your website, not a form that prompts the prospect to come in the store to finish the deal.

- Re-task salespeople and porters to create a vehicle delivery system for buyers. (It will be necessary to confirm that you have the proper insurance coverage.)

This should be the next important retail project at every dealership that’s falling behind. Sales are no longer happening at your location. You have to go to the customer now. Send your best people.

Carvana announced that they have seen a 188% increase in vehicles purchased from customers in second quarter 2019 compared to the same period last year. Every vehicle they purchase from a customer is a client lost to a franchise dealer, perhaps forever. Clearly the internet and the companies that engage this technology are not following the product arc of LeCar. Take up the challenge. Keep pace with what competitors are offering – and recognize that competitors are not just the physical dealers around you anymore.